PLG on steroids. That’s how it feels for many AI-native companies standing up product growth motions for the first time.

You face all of the same challenges as traditional product-led growth: separating signal from noise, connecting personal email sign-ups to real-world companies, building complete profiles of prospects based on product usage.

But if your product is hot in the hype cycle, the pain feels amplified to infinity.

Tons of tire-kickers sign up … then bail after the free trial period has ended (or pay for a month and churn). I’m guilty of it myself—there are a lot of new tools to try!

This makes it hard to separate the paying customers from the consumption hogs. Which makes it hard to create a predictable playbook for identifying and converting your ideal customers.

This is a blueprint for how to scale AI-native product growth based on our experience helping customers in this space—as well as insights from PLG expert Elena Verna (check out our full conversation with Elena in the video above).

Step 1: Identify your ICP (not just who you think it is)

AI is a brave new world, but growth fundamentals remain the same: Start by understanding who your ideal customers are.

Most AI-native companies offer a self-serve way to sign up, often via free trial or freemium plan.

And since there are so many companies exploring different tools to see what works, you get a lot of spaghetti thrown at the proverbial sign-up wall.

Someone’s boss tells them to “do AI,” your product comes up in an LLM search (good for you!), and it’s off to the races. But only so many people behind the chat will fit your ideal customer profile.

Odds are you already have a solid idea of who your ICP is, but data—both anecdotal and scientific—is better than gut instinct.

Take the team at Lovable—the AI-powered app and website builder.

When Elena joined to head up growth, the company pegged its ICP as solopreneurs looking to build their own apps and create their own companies.

But the data showed something different.

“There were so many employees that were engineering-adjacent that were using us inside their companies,” Elena said. “I’m like, ‘Whoa, whoa, whoa, we need to pull them into our core ICP as well.’”

Loveable is still very much focused on redefining entrepreneurship in the AI age, but that’s the long-term vision. Right now, the market pool is mostly made up of employees inside existing companies.

There are two ways to help define your ICP. Ideally you do both.

1. Run a product-market fit survey

Not sure where to start? The Sean Ellis Test can help.

Your goal is to identify users who can’t live without your product and cohort the ones who are paying customers.

Think questions like:

- What triggered you to sign up?

- How do you use the product?

- Why is the product critical to you?

You want to establish a thesis on the utility of your product straight from the horse’s mouth.

2. Review the relevant data

Start with product usage data (there are lots of product signals to choose from).

Segment product users who expand usage over time or, at the very least, retain over time. Ideally these are also paying customers.

But don’t forget to look at data outside of your product. You can glean a lot about your ICP from social and community channels like X (Twitter), Reddit, and Discord.

That’s how the team at Lovable confirmed that marketers and product managers inside existing organizations were part of its core ICP.

“We saw a bunch of social mentions of what people were building,” Elena said. “And they were excited about it. And like, wow, these people are building something that they actually want to talk about publicly, which means that it's really helped them.”

But remember, it’s not enough to hang your hat on ICP info from personal Gmail addresses. You need to be able to tie survey responses and activity data to real people at real companies.

Job titles, company sizes, annual revenue—demographic and firmographic insights are key to mapping out your ICP.

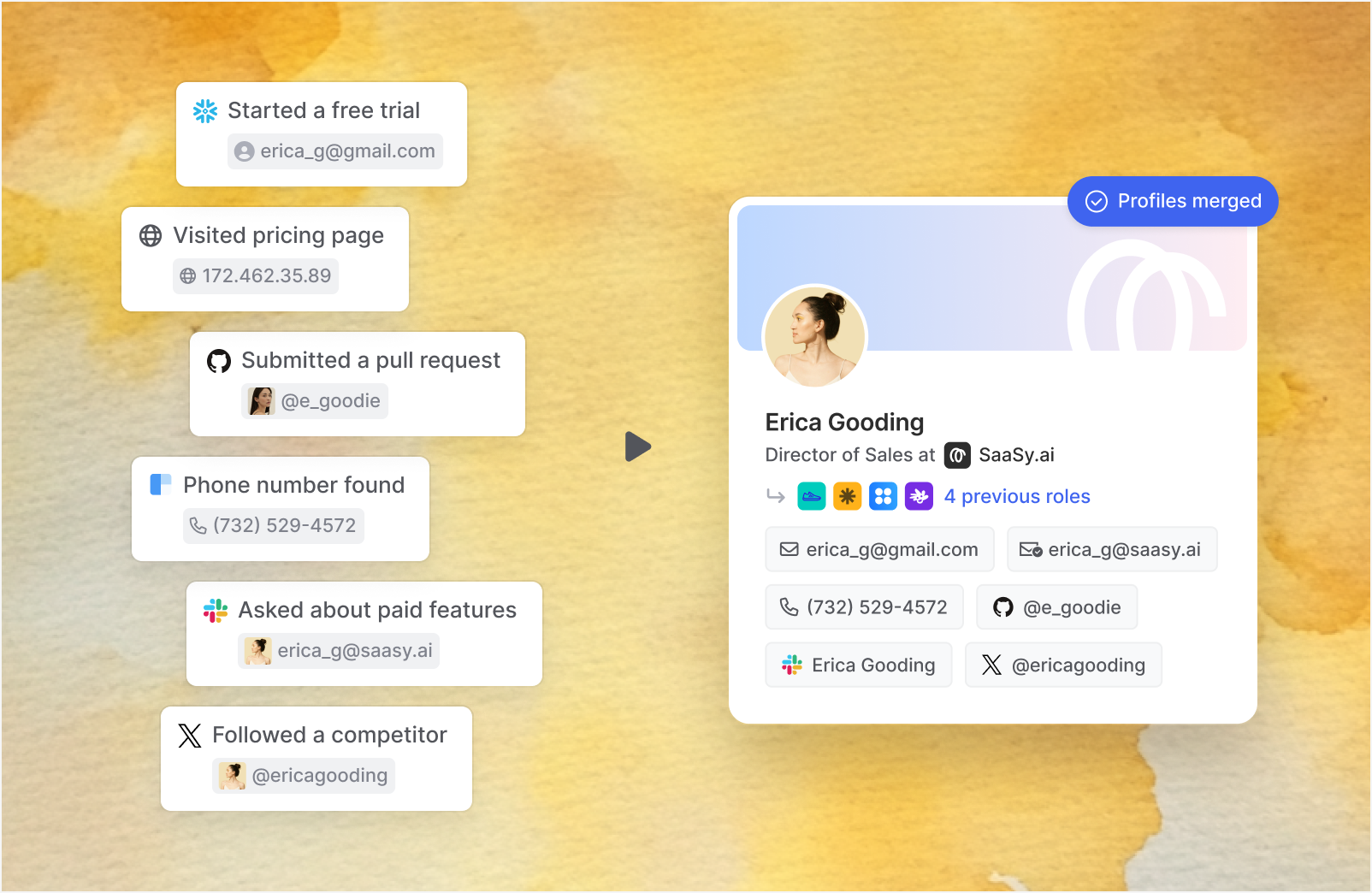

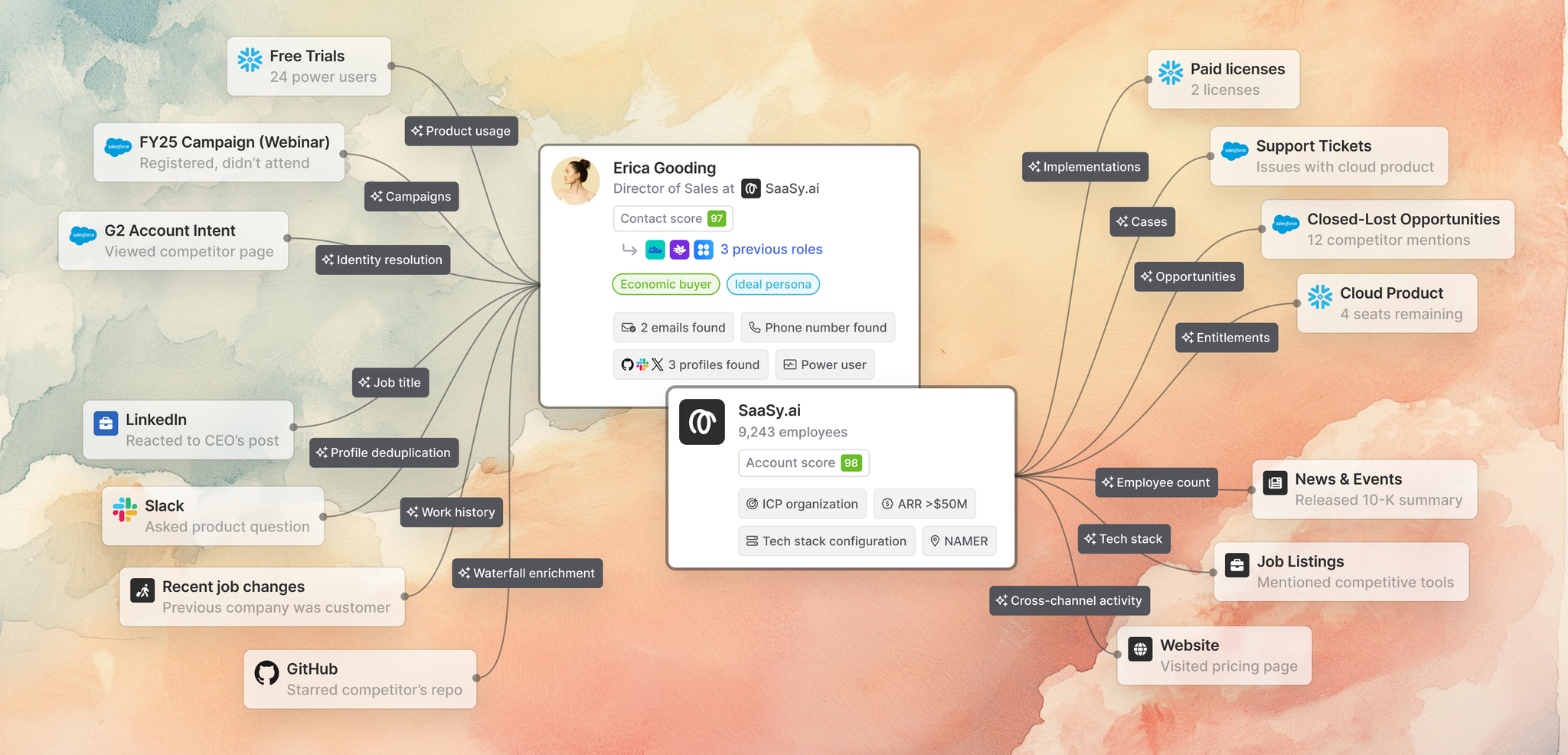

Shameless plug: Our customers use Common Room’s Person360™ identity and enrichment engine to automatically deanonymize product sign-ups and fill in the data gaps via waterfall enrichment.

Our AI will unify all data and signals from across channels to one complete profile for every contact and account—merging duplicate profiles using proprietary ML models.

This makes it easy to know exactly who is taking your product for a spin, what they’re saying about it online, and connect them to the right organization.

Once you have a clear understanding of your ICP users and their core use cases, you’ll have a beachhead (in Crossing the Chasm terms) to storm.

Going forward, you want to center your experiments, positioning, messaging, and social proof around acquiring and activating more of that ICP.

Metrics like the number of new ICP user sign-ups over a given time period and the percentage of new ICP users vs. non-ICP users will help you determine how you’re measuring up.

Step 2: Observe ICP behavior (uncover your “aha moment”)

Your next mission: Develop a hypothesis around how your ICP gets maximum value from your product—then turn that into a trackable metric.

This becomes your North Star activation goal. Once you nail it, the game is getting more ICP users to reach it—and to reach it faster.

In the PLG world, this is often called the “aha moment”—the point where a user fully realizes the value of your product and turns into a superfan who keeps coming back for more (think Facebook’s “7 friends in 10 days” metric).

Just remember that figuring out your aha moment may be a bit tricker as an AI-native product.

For one, users often interact with AI-native products differently than traditional SaaS products (aka prompting). And activity doesn’t always equal value.

“At the beginning, the aha was to get a couple of prompts under your belt, and I'm like, ‘Prompting does not equal aha,’” Elena said. “Prompting can lead to frustration. The more users prompt, the more unhappy they become because it doesn't get them the results. So we were a little bit misaligned in terms of, ‘Hey, prompting equals health,’ because it actually doesn't. And it can be the exact inverse.”

For Lovable, the “aha moment” isn’t prompt, prompt, prompt—it’s prompt, publish, and get traffic to your app or website.

Another thing to keep in mind: AI rapidly accelerates how quickly users can reach an aha moment.

Traditional SaaS often means getting set up, configuring integrations, and learning features. With AI-native products, time-to-value can be much faster.

The funnel is compressed. This makes it easier to monetize more quickly. But it can also make it harder to identify the exact product activity that qualifies as your “aha.”

Another shameless plug: Our customers use Common Room to capture granular product usage data and make it readily available to non-technical teams, minus the usual spreadsheets and dashboards.

We’ll capture and serve up any product usage info you want, molded to your internal data model, and make it immediately actionable for teams in the field.

Optimizing your product to get users to an aha moment is priority No. 1, but it’s far from the only tactic in your arsenal.

Once you know what turns your ICP into raving superfans, document it, turn it into an asset, distribute that asset to buyers who match your ICP, and repeat.

This is a growth loop you can run again and again to generate and capitalize on interest from the right audience.

Step 3: Activate your ICP (turn PQAs into paying customers)

Okay, you know what your ideal customers look like (check!) and you know what in-product behaviors translate to LTV (check!).

Time to scale. This is when you go from pure product-led growth to product-led sales.

First: Score and segment your user base using the data and signals you’ve captured. The goal is to create a list of ICP lookalike accounts you can go after based on firmographic fit and behavioral characteristics.

“You look at the existing pool of hand raisers that have converted to contracts, or at least reached some sort of S2 stage of the pipeline,” Elena said. “And then you start looking across your entire self-serve user base to say, ‘Cool, looks like a hand raiser, smells like a hand raiser, acts like a hand raiser across both behaviors that they're doing in product across the usage metrics and across any other signals that you can put in.’ And those are your initial product-qualified accounts.”

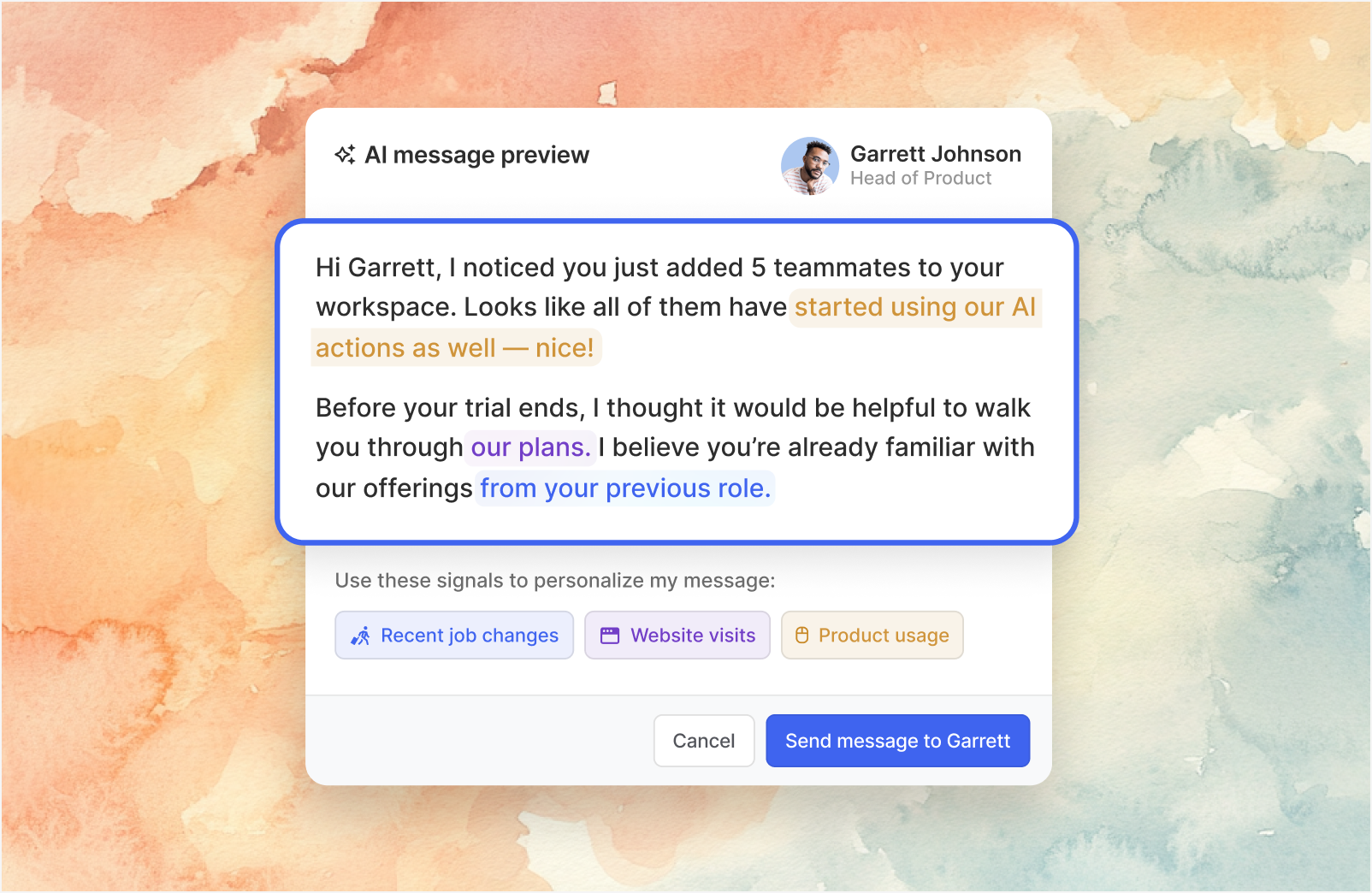

Pass those accounts to your sales team, keep them up to date on relevant activity in real time, and make sure that they can follow up with full context fast.

Once you have the engine firing for inbound product sign-ups, you can expand into outbound based on non-product usage data (think data and signals that indicate an account is in-market or would be a good fit, like competitor usage, hiring posts, and relevant news items).

This is where you’ll want to expand your signal stack outside of product data to include things like web visits, social interactions, open-source activity, community engagements, and more.

Last shameless plug, I promise: Our customers use Common Room as a sales workbench non-technical team members can use to capture and action on leads fast. Scoring, segmentation, real-time alerts, automated workflows, AI account research, agentic outbound personalization—it’s all at reps’ fingertips.

Depending on your pricing model, you might be selling credits or consumption instead of plan tiers. But the basics stay the same: Understand who your best users are and how they use you, then find and convert more of them.

It's about fundamentals, not quick fixes

If this all seems simple on the surface, that’s because it is.

The problem for AI-native companies isn’t reinventing go-to-market—it’s making sense of a sea of noise.

Pricing models may change, but signal-based GTM doesn't.

Right person, right message, right time.

It requires the right data and signals, person-level visibility, and surgical precision to make it work.

But when you can see the signal through the noise and take action on it quickly and scalably, it works like gangbusters.

Turn buyer intelligence into pipeline with AI

Get in touch to see how Common Room’s GTM AI shows you who to target, when to engage, and how to convert.