Product-led growth (PLG) is a goldmine of buying signals you can use to increase conversions, expansions, and renewals. But only if you know what to look for.

Some signals are obvious. Others? Less so.

Here are the PLG buying signals your sales team should be tracking.

In PLG business models, buyers can find, test out, and purchase your product without any interactions with your sales team. This model generates buying signals—most often in the form of product usage data—that sales reps can use to uncover additional opportunities, scale revenue growth, and break into enterprise deals.

Conversion signals

Why you should care

There’s a reason PLG is growing like gangbusters—75% of B2B buyers want a rep-free sales experience.

Still, data shows that human-led sales motions are still the best way to power sustainable growth and increase conversion rates.

With buyers preferring to self-serve—leaving reps with only 16% of the buying cycle to work their magic—it’s crucial to keep an eye out for signals that will tell you who to reach out to and when.

Obvious signals

New account sign-up

When someone signs up for a free trial of your product (or the freemium version of it), it’s a clear sign of interest.

Trial end or paid ceiling approached

If time is almost up on a free trial, it’s time to reach out and convert the user into a customer (or, at the very least, extend the trial in exchange for a conversation with the sales team).

It’s the same story when a freemium user reaches a paid ceiling threshold. Whether it’s based on the number of seats, API calls, or something else, if users are reaching their self-serve limits, it’s a surefire signal that a conversation is in order.

Read our case study to see how the team at Apollo GraphQL combines product usage data with other buying signals to identify and qualify prospects.

Less obvious signals

Sign-up flow abandonment

Think of abandoned sign-ups like abandoned shopping carts—the buyer was close to the finish line before they bounced. They may just need a little follow-up to seal the deal.

Rapid rise and fall in product usage

It’s common for companies—especially enterprise organizations—to run a high-scale test of a product when evaluating potential vendors. If you see a huge spike in product usage followed by a huge drop, there’s a good chance you were part of a proof of concept.

Compliance or IT user identification

Compliance and IT professionals aren’t usually economic buyers, but they are tasked with making sure products meet internal security and cost benchmarks. If you spot one giving your product a test drive, it’s time to prioritize that opportunity.

Expansion, upsell, and cross-sell signals

Why you should care

When product users are showing signs of wanting more—more features, more seats, whatever the case may be—it’s a cue to take action. Swooping in at the right moment serves them and your bottom line.

If you keep your eyes peeled for organic opportunities for expansion (setting up real-time alerts to surface them never hurts)—either in the form of increased usage limits, additional seats, or net new SKUs—you can significantly boost customer lifetime value.

Research shows that upselling and cross-selling are each responsible for 21% of company revenue on average.

Obvious signals

Integration connected

When a user connects a new integration to your product (think a CRM or data warehouse), it’s a sign that they plan to use you for the long haul (and maybe have a new use case to discuss).

Upgrade screen activity

If someone is viewing your upgrade screen but not following through, odds are they’re looking for the answer to a problem they don’t know how to solve. Setting up a call to discuss is a great way to take a consultative approach.

Multiple workspaces created by single organization

If multiple teams from one organization are using your product separately, it’s an excellent opportunity to talk through consolidating them under one account. Even if this results in a nominally smaller monthly spend, it’s worth it in exchange for a longer-term commitment.

Multiplayer product activity or product link share

If multiple people are collaborating in the same corner of a workspace (think a shared Figma file or Miro board), it’s a sign of shared value and an opportunity to add seats.

The same goes for when product users share links to assets created in your product (think Figma or Loom) with non-product users.

Power user threshold reached

If someone is among your top 1% of users, there’s a good chance they can’t live without your product. Now would be a good time to see if they’re underpaying or could benefit from extra features.

Check out our conversation with StackBlitz to learn more about how PLG companies can use product data to grow revenue:

Less obvious signals

Surge in product log-ins

If you’re seeing a prolonged spike in product log-ins, it might mean you have a power user on your hands. It may also indicate that users are sharing log-in credentials and it’s time to talk about expanding the number of seats.

Product activity after stagnant period

When product users or prospects go dark—no log-ins, no usage, no responses to outreach—and then resurface? It’s often a signal of a new initiative or use case being prioritized. Time to get in touch.

Churn signals

Why you should care

Holding on to existing accounts is essential to efficient revenue growth—especially in a tough selling environment.

Ninety-two percent of reps say they’re now at least partially evaluated based on post-sale metrics such as customer retention.

This makes the ability to spot signs of trouble—and opportunities to deepen customer relationships—business-critical.

Obvious signals

Lack of or sudden drop in product activity

If people aren’t regularly logging in or using your product features, they’re not truly activated. This is a sign to work on enabling users and their teams.

And if a long-time customer suddenly stops using your product? That’s a sign of a deeper issue, such as a product champion leaving the company. It’s worth digging into.

Reduction in seats

Fewer licenses doesn’t just kill your annual recurring revenue—it’s also a sign that changes may be on the horizon. Maybe a team is getting smaller or the company is pivoting its strategy. Either way, it’s important to check in to make sure you don’t end up on the chopping block.

Bug question or complaint

Not all product issues are a sign that a customer is getting ready to jump ship, but they are a cry for help. If a ticket gets created or a question pops up in your community or support forum (especially if it’s from a high-fit account), make sure you can spot it.

Less obvious signals

Org change

People change jobs every day. While a former product user joining a new organization is a great opportunity to break into a new deal, it’s also puts your current customer at risk. It’s important to follow up with the account and work on cultivating multiple internal champions.

Integration disconnected

If adding an integration to your product is a sign of long-term loyalty, disconnecting one can mean the opposite. It may just mean that the integration in question wasn’t adding value and the customer is switching to a more cost-effective or feature-rich solution. Then again, it could mean they’re thinking the same things about you.

Integration neglected

Some integrations have to be reauthenticated on a regular basis to keep data flowing. If an organization lets an important integration lapse without taking action, it’s a sign that they’re either not seeing a ton of value from it—or not seeing a ton of value from your product.

Common Room helps you action on all product activity

Digging through product usage data can feel like drinking from a fire hose.

But not with Common Room.

Here’s why.

Connect your data

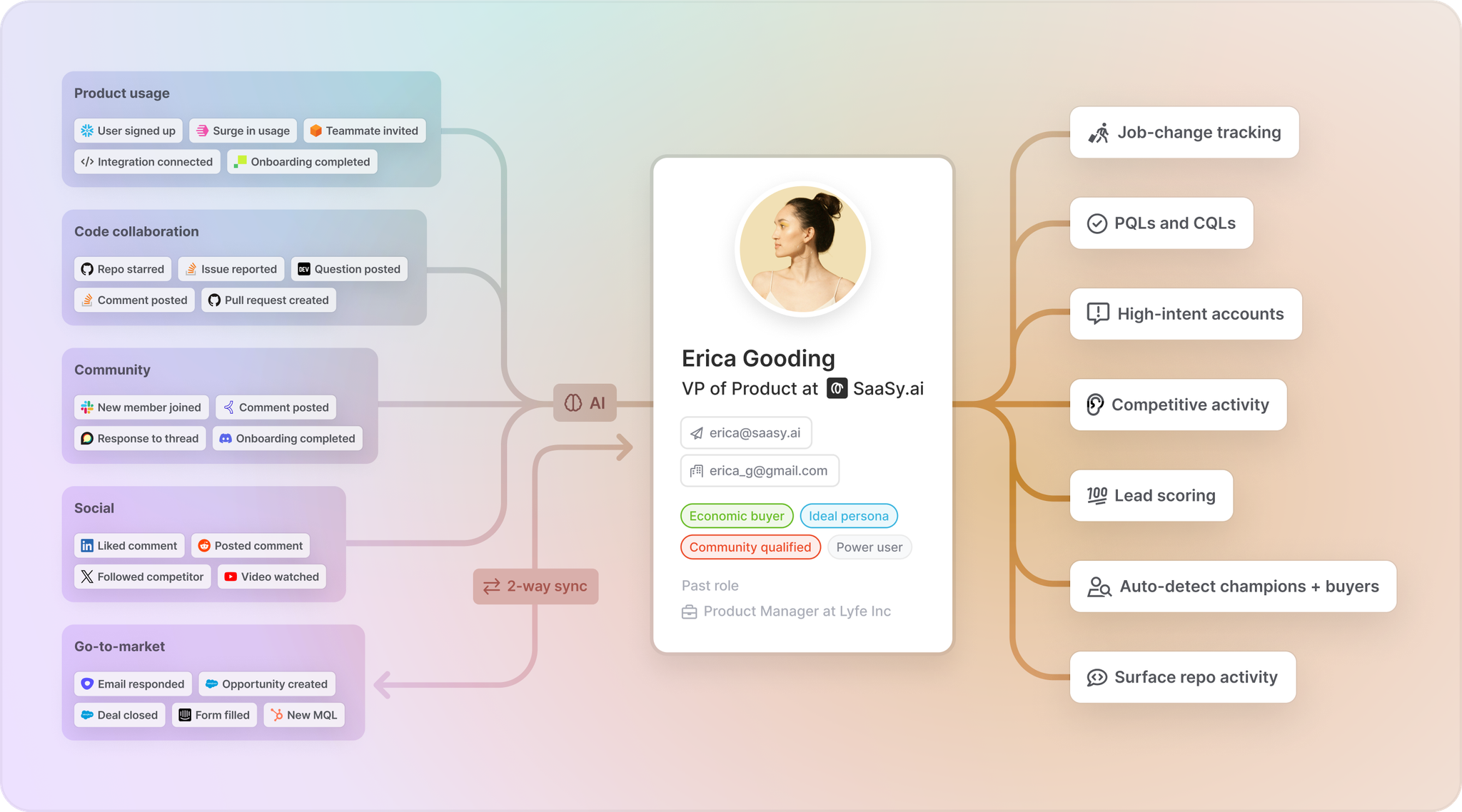

Pump your product data directly into Common Room using our natively built and fully managed integrations. Our proprietary identity and enrichment engine—Person360™—will do the rest.

We’ll automatically capture every action across product, web, social, community, and more and match it to a unified profile for every person and organization in your digital ecosystem.

You get full visibility into the buyers and customers you want to know about and complete context for their behaviors in your product and beyond.

Surface your signals

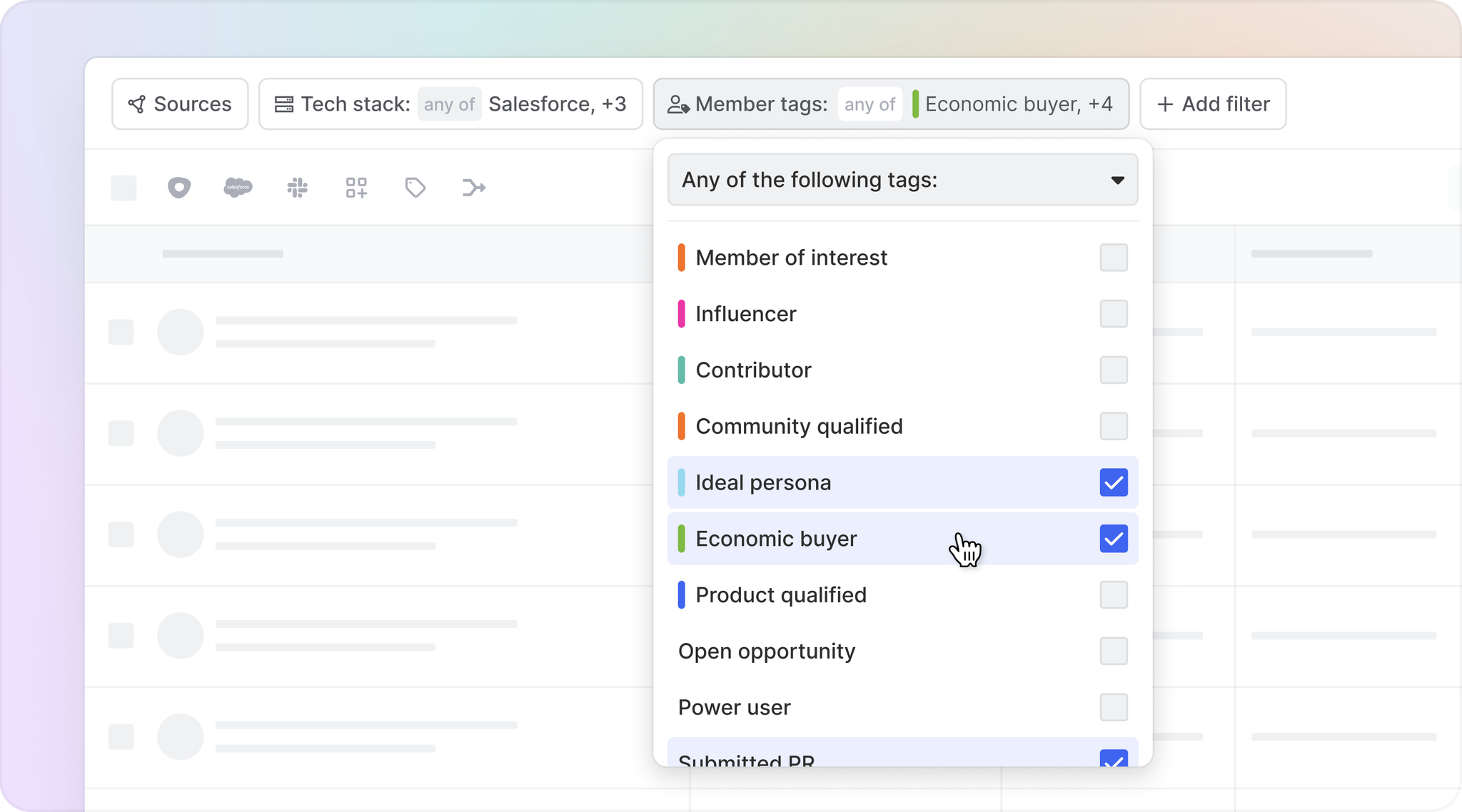

Put our user-friendly filters and tags to work to slice and dice your data fast.

Explore product usage across any dimension, including demographic and firmographic details, to hone in on specific activities and accounts.

And prioritize your time by surfacing specific personas—such as product-qualified leads, economic buyers, ideal customers, and more—automatically.

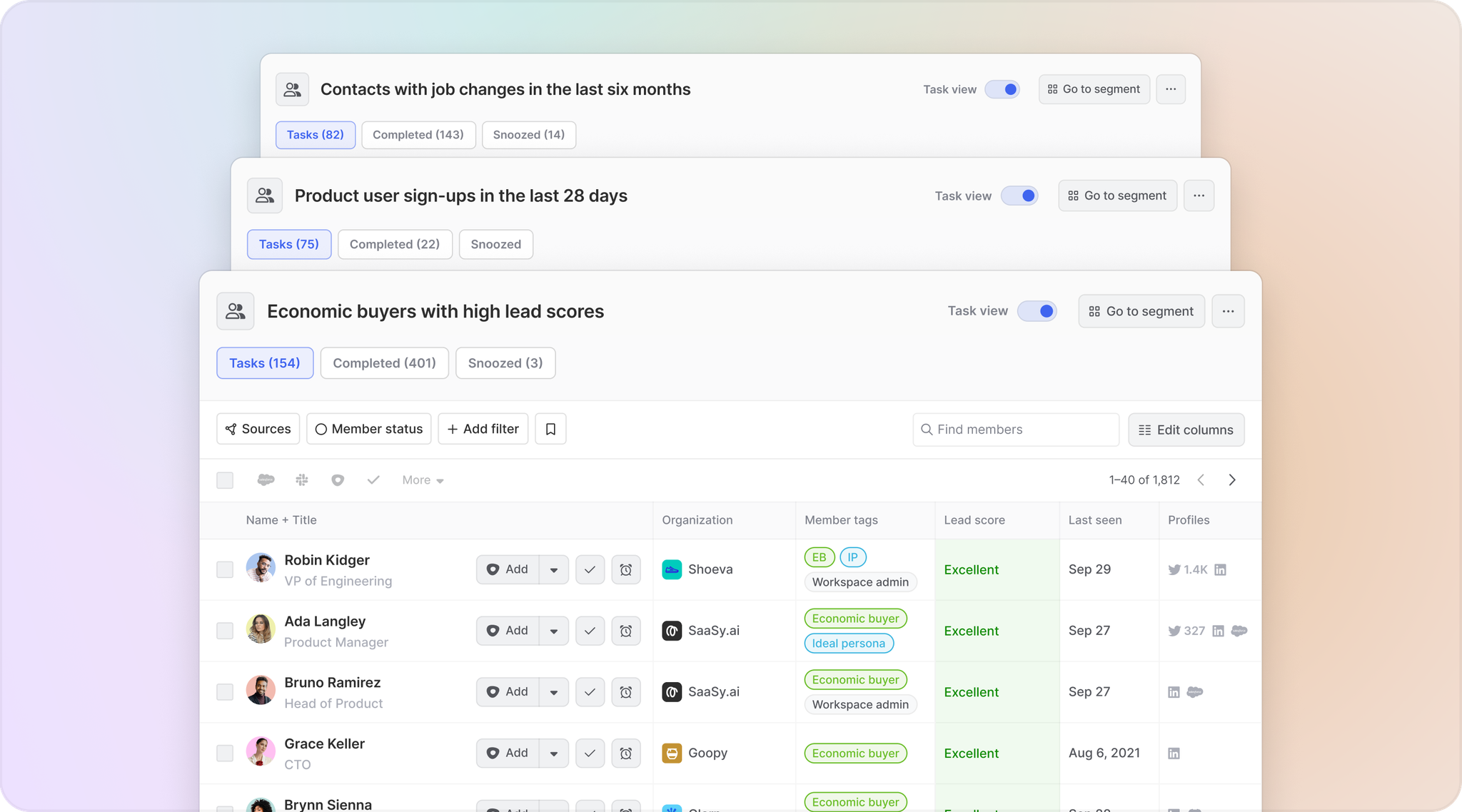

Execute your outreach

Take action on high-intent prospects and closed-won customers without breaking a sweat (or switching interfaces).

Automate real-time alerts based on any combination of triggers so you’re always up to date on activities among accounts. Automatically add people and companies to dedicated segments using customizable criteria so you can track your book of business fast.

And reach out on the right channels—from personalized email to Slack message to LinkedIn DM—all from the same place. No context switching necessary.

Product data can tell you a lot, but only if you’re listening.

Be sure you have the tools you need to turn PLG buying signals into real results.

Parse PLG buying signals with Common Room

Get started for free or get in touch to see how Common Room helps you turn product usage into customer intelligence.