We’re all familiar with standard intent signals—content downloads, free trial sign-ups, demo requests.

But potential pipeline comes in all shapes and sizes. Not every buyer raises their hand so obviously.

Here are five examples of buying signals you might be missing out on.

Buying signal, sales signal, buyer intent—they’re different words for the same thing: actions and behaviors that indicate someone is interested in doing business with you. More data means a bigger pool of signals. But with so much buyer data buried in the dark funnel, sales teams often settle for surface-level insights.

1. Spike in social activity

What we mean

Social media offers a ton of actionable intel once you skim past the latest TikTok dance compilation.

Odds are your company shares content on LinkedIn. Ditto for your company leaders. Say someone who matches your ideal buyer persona begins liking and commenting on these posts on a regular basis (bonus points if they’re asking detailed product questions).

Before you know it, they're in the upper echelons of activity level. If they check enough boxes—right job title, right organization size, right industry—they’re worth digging into.

Why you should care

Not every social interaction is worth writing home about. Maybe this person is just a fan. Maybe they’re an aspiring influencer trying to establish a following.

Or maybe they’re a buyer researching solutions.

Seventy-five percent of B2B buyers use social to make purchase decisions. At the very least you’ve discovered someone who’s expressed interest in your offering. Goodbye cold call, hello warm LinkedIn DM.

What’s stopping you

Buyer interactions come fast and furious on social channels.

Reps don’t have time to sift through each and every notification across LinkedIn, YouTube, and (the artist formerly known as) Twitter.

Even if they did, identifying and qualifying the people who fit your ICP would be a huge time suck.

2. Surge in community engagement

What we mean

Community channels—Slack and Discord chief among them—often get skipped over by sales reps.

It’s true that most communities are populated by existing customers. In other words: New revenue opportunities are limited.

But non-customers often join brand communities to try before they buy. A surge in activity from someone without a record in Salesforce is a dead giveaway.

Why you should care

Forty percent of B2B SaaS companies have dedicated brand communities. That number is even higher for product-led organizations (55%).

Savvy shoppers use this as an opportunity to evaluate their options.

They want to get a feel for the general vibe of your community, check out what kind of support they can expect, and collect warts-and-all assessments from existing customers.

Check out our conversation with Keyplay and PeerSignal to learn more about how product-led companies use community to land and expand deals:

What’s stopping you

No matter where your community lives, staying up to date on the latest activity is time-intensive (just ask your friendly neighborhood community manager).

As a rule, reps don’t usually have the bandwidth to investigate every new community sign-up.

Plus, separating current customers from high-fit prospects can be a job in and of itself.

3. Keyword mentions in online forums

What we mean

Buyers aren’t just congregating on your owned channels.

They’re talking about you, your product, and your competitors across a wide range of digital watering holes.

And these conversations can be a treasure trove of potential leads.

Why you should care

Ninety-two percent of B2B buyers are more likely to make a purchase after reading a review they trust.

But reviews don’t just live on G2. They’re often happening in real time.

Buyers regularly consult their peers on Reddit, Stack Overflow, and other channels to source recommendations and narrow down their shopping lists.

Read our case study to see how the team at Temporal uses signals from online forums, social media, and other channels to surface and qualify fresh pipeline.

What’s stopping you

No one has the time to scour every forum thread on the off chance that they’ll stumble over a relevant conversation. Least of all sales reps.

And if they did, they’d find it hard to separate the signal from the noise. Online forums don’t serve up actionable insights on a silver platter.

You’re more likely to find pun-based usernames than firmographic details.

4. Rapid rise and fall in product usage

What we mean

Not all free trials are worth your time (although it’s hard to tell when people are signing up with their personal email addresses instead of their company domains).

Still, if multiple people from a free trial account sign in, put your product through its paces, then suddenly disappear?

That’s a sure sign that you were being evaluated as part of a vendor selection process.

Why you should care

Product-led growth (PLG) is now the norm—61% of the Cloud 100 are playing for team PLG. But figuring out which tralists to pay attention to can feel like drinking from a firehose.

When you see a surge in product usage—followed by an equally rapid decline—it’s typically a sign that a team was testing out your product as part of a proof of concept.

Odds are they were doing the same thing with one of your competitors.

What’s stopping you

Product usage data is hard to come by when it’s stuck in Snowflake (or Hightouch…or Census…or, well, you get the idea).

Most times the best a rep can hope for is a CSV export (or, if they’re lucky, a data team-approved dashboard with limited functionality).

This makes it hard to keep tabs on product activity at speed or at scale.

5. Account activity in open-source repositories

What we mean

If you’re an open-source software company, GitHub is a goldmine of sales signals.

Let’s say one person stars your repo so they can save it for later. It’s not exactly a bluebird deal, but it’s worth following up on.

Now imagine if multiple people from the same organization star your repo. You just went from “dev who might be interested in our premium solution” to “team that’s likely speccing out a project.”

Why you should care

It’s tough to separate the forever hobbyists from the enterprise opportunities when you’re selling to developers.

If multiple people from the same company are bookmarking your repo, there’s a good chance a team is evaluating your software for implementation (or already using it).

It’s time to brush up on your technical jargon and get in touch before the organization builds their tech stack around your free offering.

What’s stopping you

When it comes to open-source activity, anonymity is a feature, not a bug.

Unless you gate your software or have a sales rep standing sentry over GitHub (one who’s ready to research every username), you’ll have very little visibility into who’s using your code.

Besides, even if you enforce some type of log-in mechanism, devs could still access your software from a third-party repo.

Common Room helps you uncover every buying signal fast

Keeping track of every buying signal—quickly, scalably, and across channels—used to be impossible.

Now there’s Common Room.

Here’s how it works.

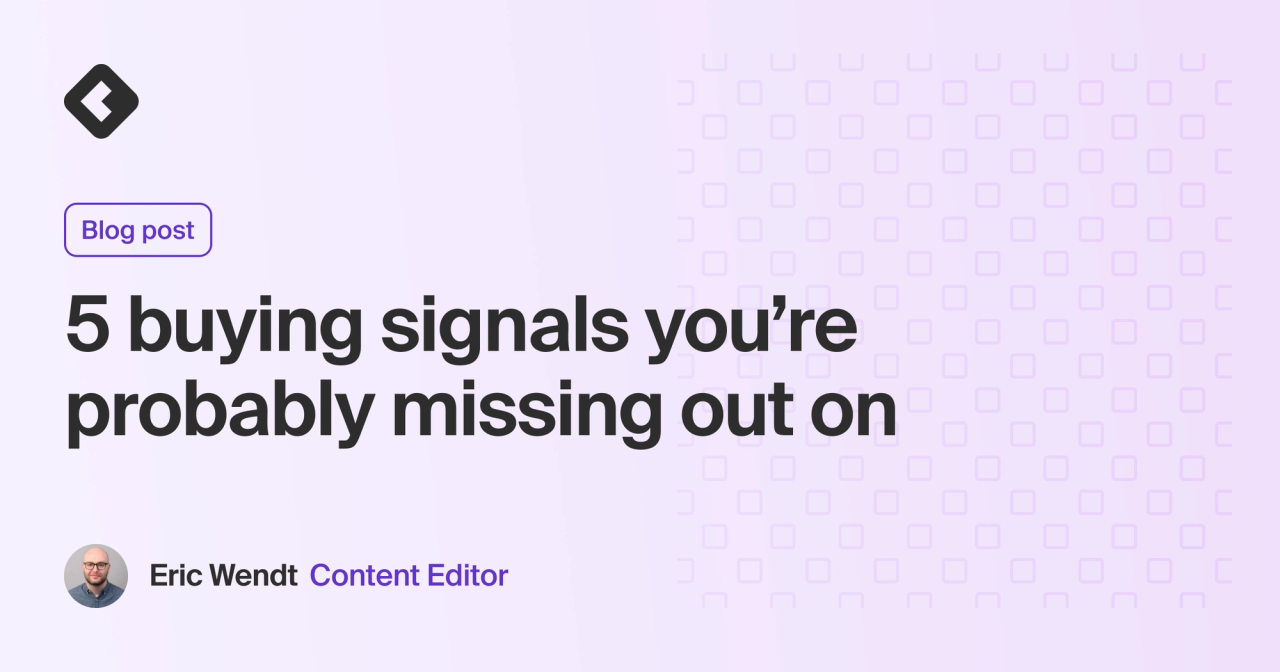

Connect your data

Choose from dozens of integrations with popular data sources—from social to community to product and beyond—so you can pull in every signal that matters.

Hook them up to Common Room and watch your data go from anonymous to actionable in an instant.

Our proprietary identity and enrichment engine—Person360™—automatically creates full profiles for every buyer and organization in your digital ecosystem.

Surface your signals

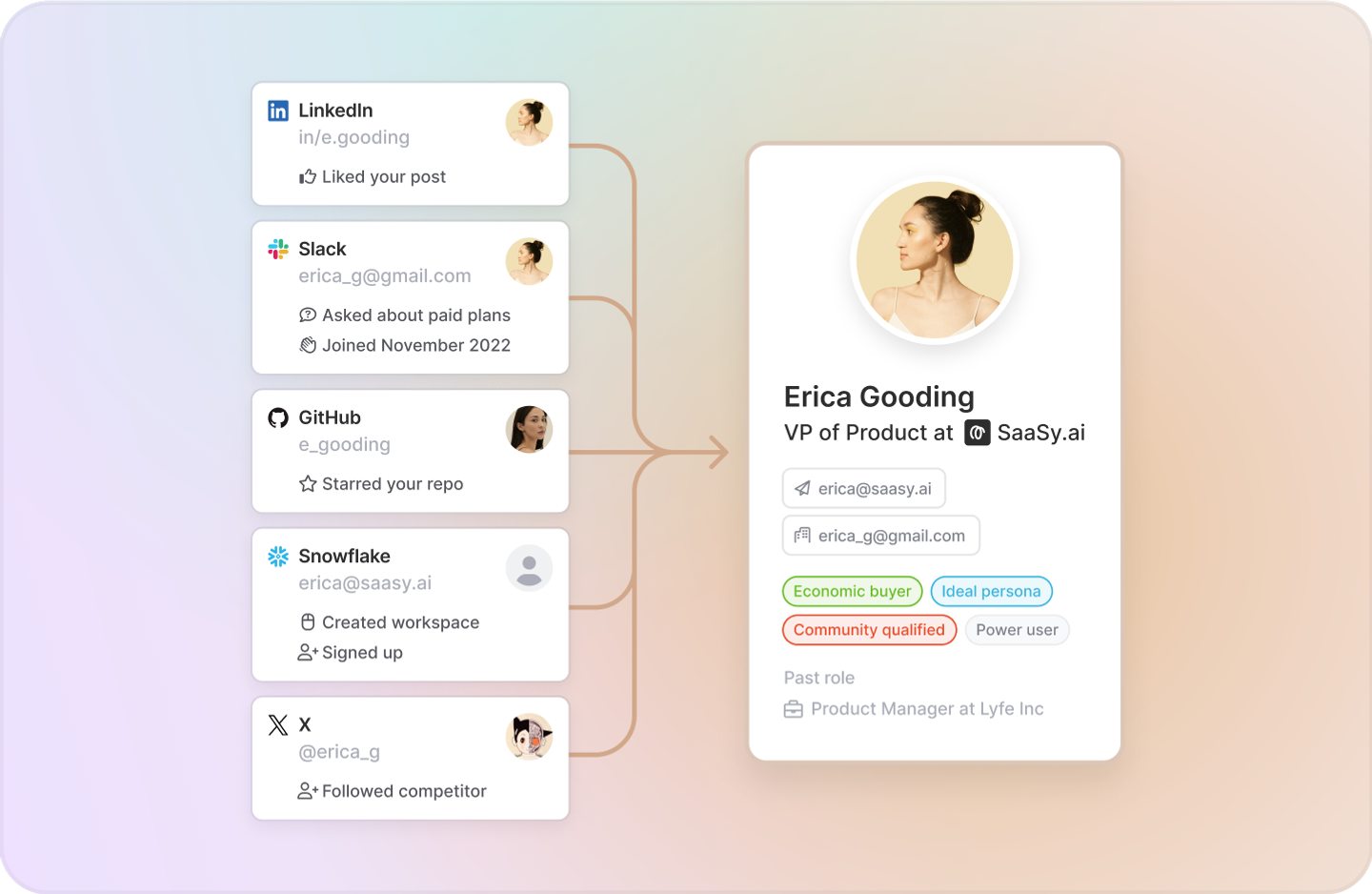

Hone in on high-intent buyers based on their cross-channel activities.

Filter by data source, type of activity, activity level, keywords, time frame, and much more with the click of a button.

Automatically surface economic buyers, product-qualified leads, ideal customers, and other target personas using customizable tags.

And see which prospects are primed to buy with contextual lead and account scoring.

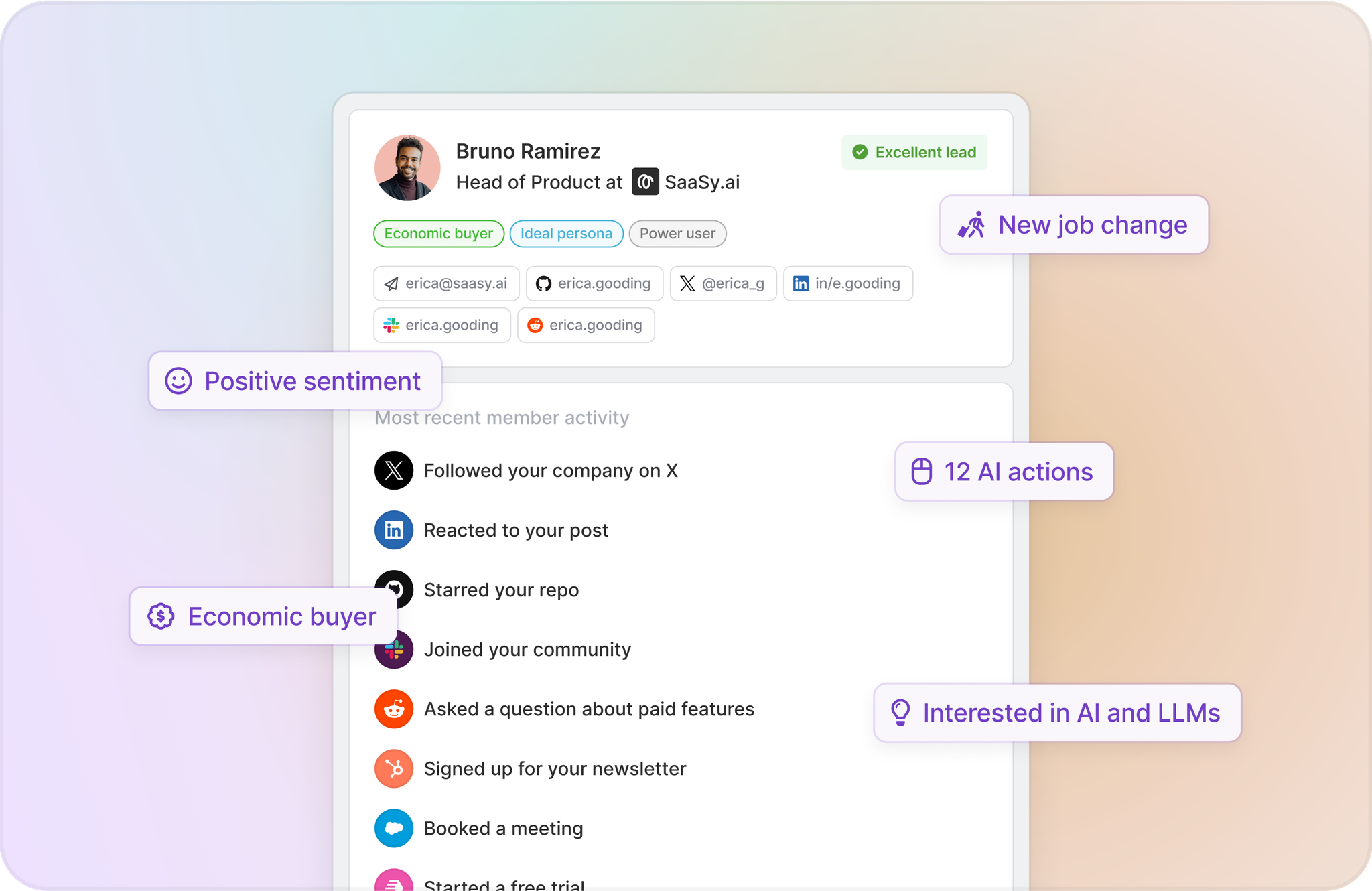

Execute your outreach

Turn intent into pipeline without context switching.

Set up real-time alerts to surface new opportunities you want to know about. Automatically add people and organizations to dedicated segments.

Then reach out with a personalized email or DM and sync their records with your CRM—all from the same place.

You can find, qualify, and connect with buyers without ever swapping tools.

Modern buyers generate a sea of signals you can use to uncover pipeline opportunities. These are just five examples.

Make sure you have the tools you need to find and follow up on them.

Never miss a buying signal with Common Room

Get started for free or get in touch to see how Common Room can help you turn any buyer activity into pipeline.