Most B2B SaaS companies have a product-led growth motion. Now all they have to do is figure out how to build a product-led sales (PLS) strategy to match.

Even the biggest “the product sells itself” companies you can think of—Slack, Figma, Atlassian—eventually need to turn upmarket. And they do it by pulling from a well-established playbook: traditional enterprise sales.

Put another way: Product gets prospects through the door, but the sales team gets enterprise accounts to sign on the dotted line.

Keep reading to learn:

- What separates PLS from other business models

- Why your current game plan may need some tweaking

- How to build a product-led sales strategy that shines

The ABCs of PLS

The product is the end of the road in traditional sales. In product-led sales, it’s the starting point.

The average sales cycle used to begin in one of two ways: Either someone would visit your website and raise their hand for a demo or an outbound sales rep would target an account to get a conversation going.

Either way, sellers were the product gatekeepers.

PLS turns that on its head. When buyers can sign up for a free trial or start using a free forever plan on their own, the product itself becomes the lead generation mechanism.

Based on user activity in the product—how often a person signs in, which features they use, whether other team members join them—sales teams can reach out to talk about their paid offering.

The methods may be different, but the objectives remain the same: Attract buyers, zero in on the ones with the highest intent, and convert them into paying customers.

Product-led sales vs. product-led growth

Product-led sales and product-led growth are sometimes used interchangeably, and it’s easy to see why: Product-led growth typically evolves into product-led sales.

Product-led growth companies that want to scale (aka all of them) usually bring in sales people as they grow, naturally transforming their business models in the process.

But at the start, it’s all about letting the product do the talking. With a product-led growth model, buyers find your product on their own, test it out on their own, and purchase it on their own. No sales touch required.

The trouble is that it’s exceptionally hard to scale on credit card transactions alone. Eventually companies will hit the self-serve ceiling in terms of usage and revenue.

Product-led sales builds on product-led growth by giving customer-facing teams the insights they need—in this case, product usage data—to identify and target opportunities with high annual contract values.

Companies often employ both models. They’ll stay strictly self-service for smaller opportunities and break out the sales team for enterprise deals.

But it’s important to remember that hiring warm bodies isn’t a strategy in and of itself.

Why your product-led sales strategy isn’t working

Product-led business models make it easier to find high-intent prospects—but only if you have a clear view of user activity.

Many product-led sales teams aren’t even using product-qualified leads (PQL). Whether it’s too difficult to get product data into the hands of sellers—or sellers simply can’t make sense of the data they have—sales teams are often blind to the product users they should be paying attention to.

On the flipside, some sales teams are drowning in buying signals, which makes it difficult to keep up with product users and prioritize outreach accordingly.

Even if sellers have the luxury of a data team that feeds them PQLs, product data is still only one facet of the customer journey. Sales teams don’t have visibility into everything happening outside of the product.

Reps can’t deliver on deal size and deal velocity if they don’t have the data they need or are unable to act on it quickly. Sellers find themselves spelunking across channels—using tools that weren’t designed for their workflows—to get context. Or they over index on the one or two tactics that seem to work.

Worse yet, they’ll stick with the status quo of spray-and-pray outbounding.

This leads to reaching out to the wrong people. Or reaching out too early. Or reaching out in the wrong place.

They don’t have the insights they need—intent signals from qualified accounts—to score a meeting with the right prospect at the right time.

Sellers are not overly technical, and they can only make so many asks of the data team. They need a way to self-serve user insights fast instead of waiting on someone else to do the heavy lifting.

How to build a product-led sales strategy that works

If you’re hitting roadblocks with your product-led sales strategy—siloed data points, anonymous buying signals, limited user context—give these tactics a try:

Scale what works

Not all product data is created equal. Throwing a sales rep in the deep end of a data pool won’t do anybody any good.

Help sales teams hone in on meaningful signals—such as multiple users being added to an account—and prove that they lead to better opportunities before moving on to the next data point.

Make user data actionable

It’s not enough to collect product usage data. It has to be surfaced to reps within their natural workflows and packaged up in a user-friendly way.

Sellers need to be able to take action without constant context switching. Invest in tooling that’s designed for the way sales teams work.

Deanonymize product users

Product data isn’t people data. Product users often sign up for a free trial with a personal email address.

Make sure sellers know exactly who they’re talking to so they can quickly decide whether an opportunity is worth their time.

Go beyond product data

Product usage is the foundation of product-led sales, but it doesn’t reveal the biggest and best opportunities on its own.

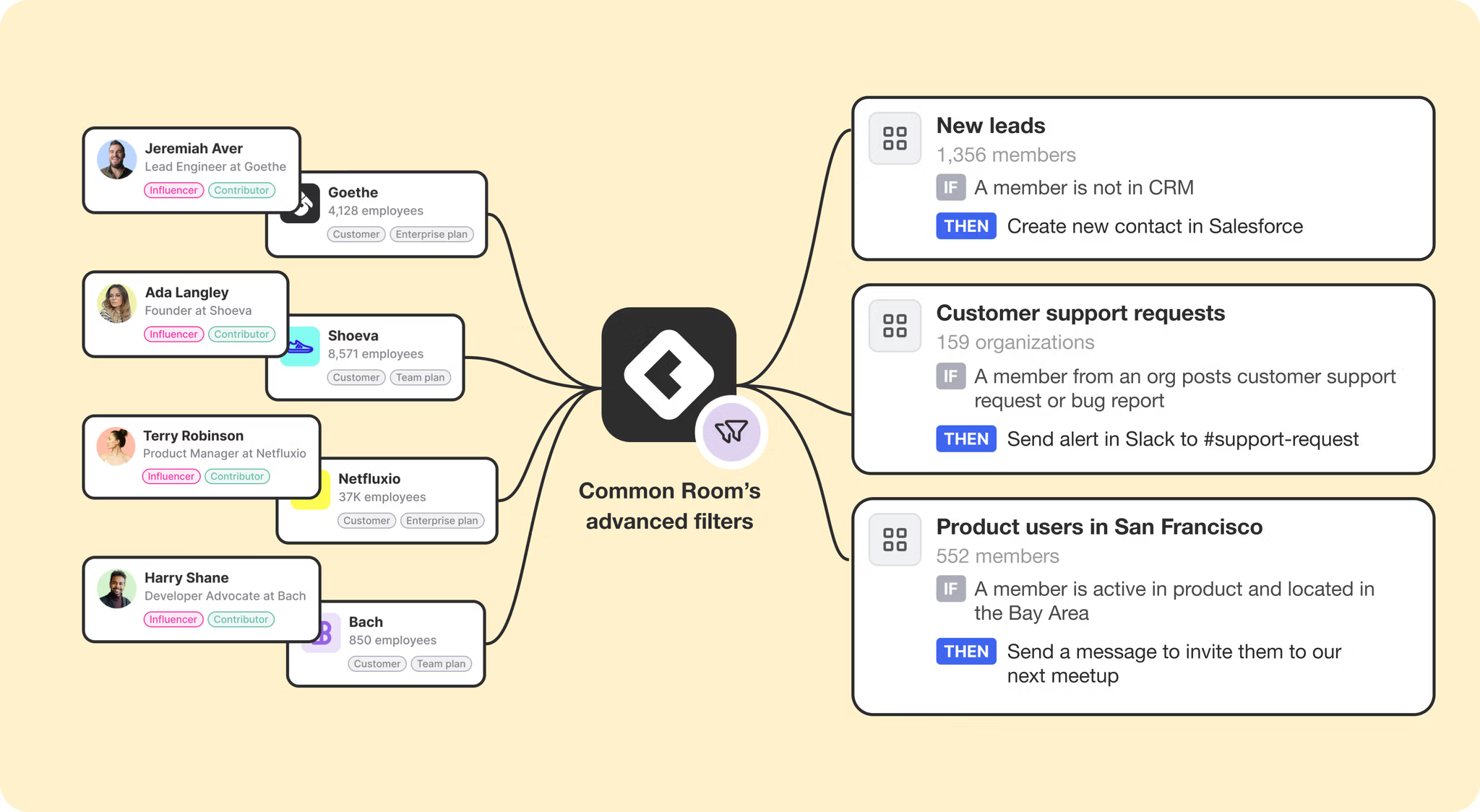

Give sellers visibility into all relevant data points: interactions and conversations across dark-funnel channels, product activity among economic buyers, relationship context recorded in your CRM. Then make sure these insights are centralized and easily accessible.

Focus on fit

Not all product users are enterprise opportunities. In fact, only a small percentage of them are.

Sellers need to be able to combine product intent signals with other key data points in order to prioritize high-propensity accounts. Visibility into insights such as organization size, annual revenue, capital raised, tech stack, and more are key to achieving this.

Know when (and where) to act

Knowing who to reach out to is step one. Knowing when and where—and doing it quickly—is just as important.

Too soon and you’ll spook a product user. Too late and you’ll miss your opportunity. Ensure sellers have tools that tell them when to move on an opportunity and the best way to go about it, whether it’s an email, Slack message, or LinkedIn DM.

How to nail your product-led sales strategy with Common Room

Common Room is designed to enhance product-led sales strategy.

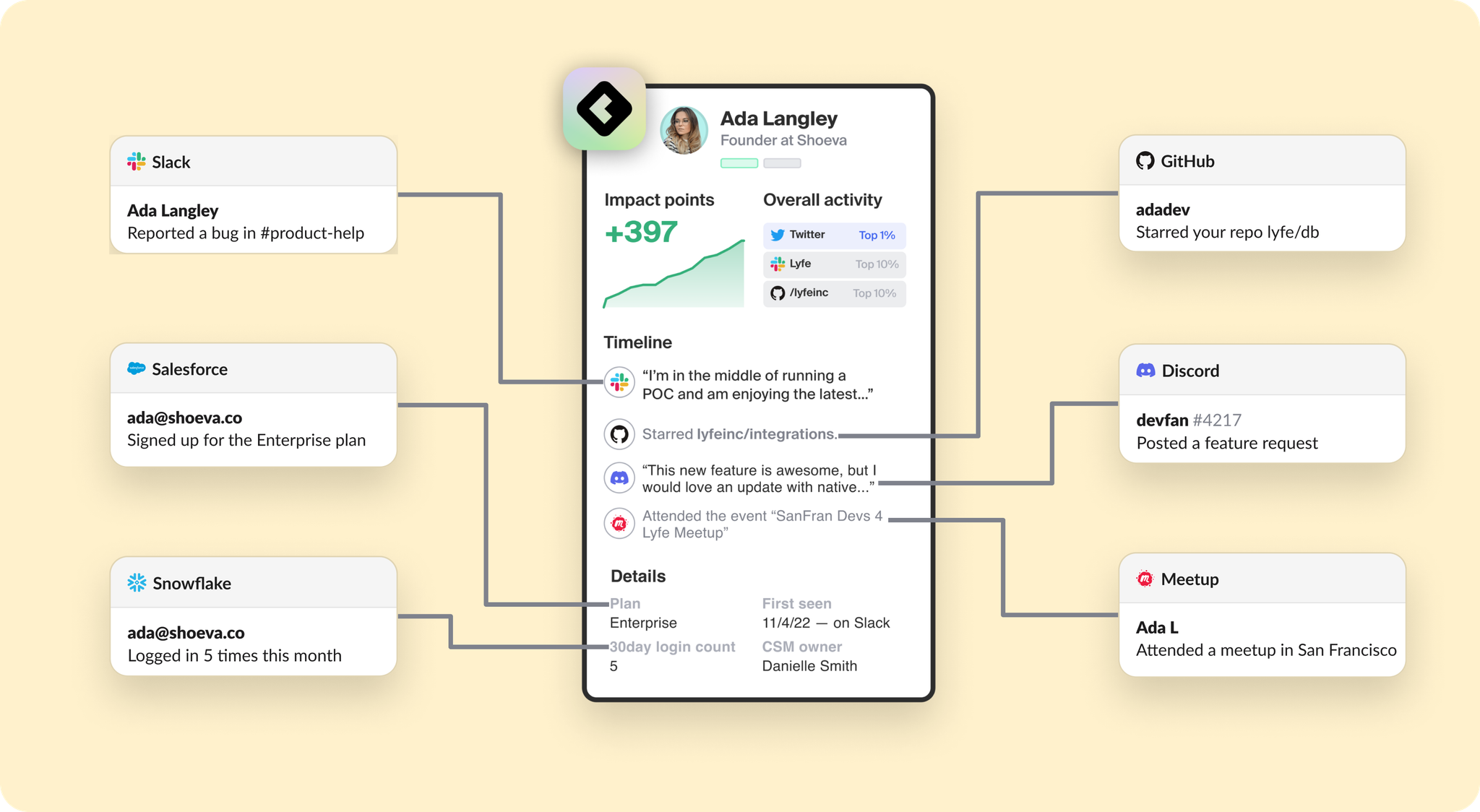

Dozens of natively built and fully managed integrations—including with product data warehouses and CRMs—make it easy to centralize all relevant buying signals in one place. Meanwhile, AI-powered identity resolution and enrichment transform anonymous user signals—activities on social media, feature usage within a product, customer history—into unified user profiles.

Sellers can quickly double-click into any individual or organization to get a bird’s eye view of their interactions inside and outside the product.

“The insights brought together by Common Room ensure our team can engage with the right person at the appropriate time with an offer that truly aligns to their needs.”

—Allie Beazell, Marketing Chief of Staff and Director of Developer Marketing at Census

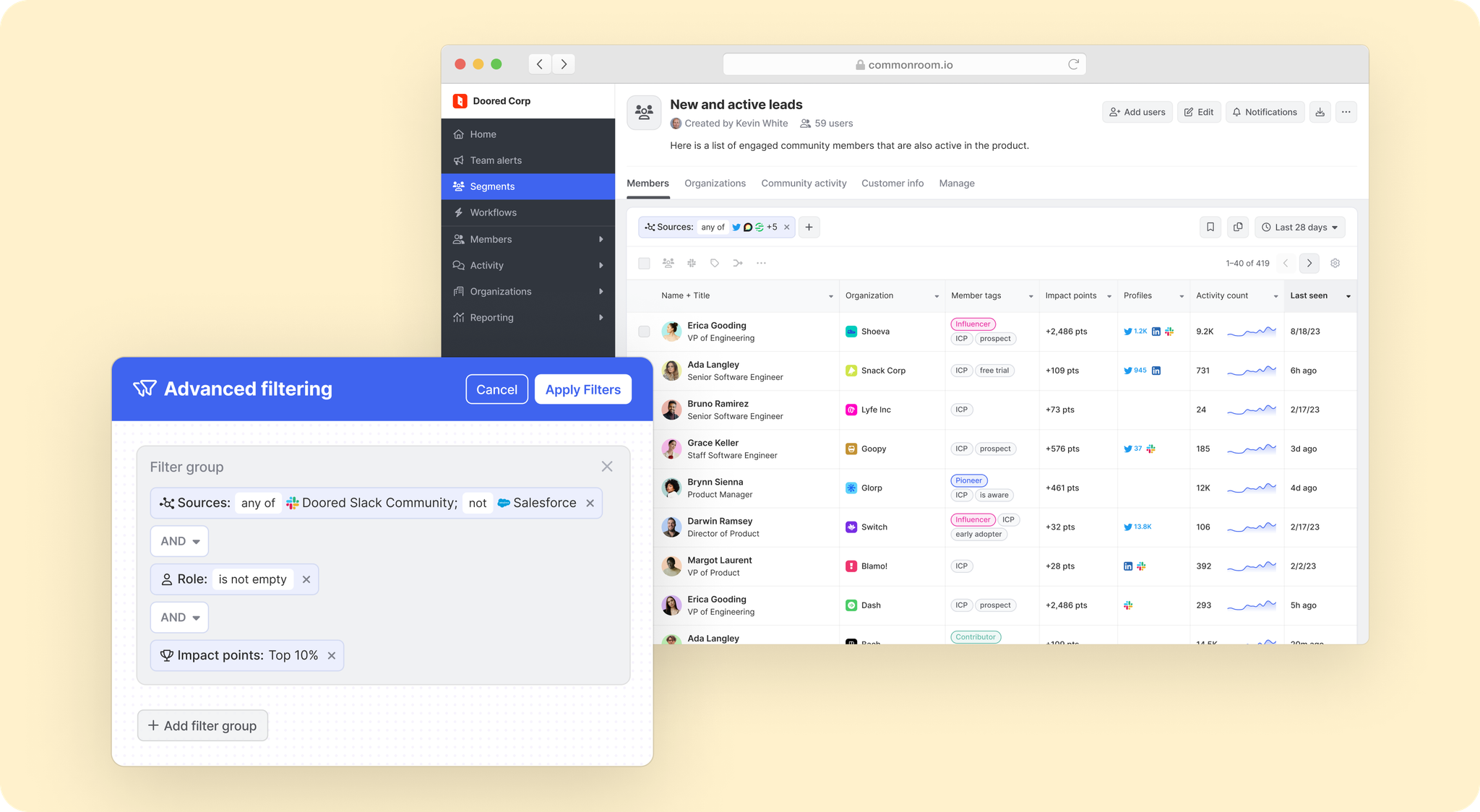

Filters, tags, and other features make it easy to qualify product users based on customer fit. There are filters for job title, role, organization size, industry, tech stack, and much more. At the same time, tags help sellers automatically identify individuals and organizations with key attributes, such as ideal personas, economic buyers, and product-qualified leads.

Sellers can quickly drill down into the characteristics of individual users—as well as the companies they work for—to spotlight the high-value opportunities that are most likely to convert.

"It’s the first tool that doesn't add more work to the mix. It actually pulls things together in one central spot and is the one place my team can go to see what's happening in the program, rather than going to each one of our different tools. Above all, it saves our team the time and frustration of having to pull data and then manually make sense of it."

—Joshua Zerkel, Head of Global Engagement Marketing at Asana

PQLs can be added to dynamic segments where sellers can turn groups of leads into burn-down lists. They can add them to Outreach sequences, send them emails, send them Slack DMs, or send them to Salesforce—all with the click of a button and all from the same place.

Automated alerts and workflows also make it easy to stay updated on any activity among product users and automatically reach out to them on the channels where they spend their time.

“Common Room gives me a daily feed of all the prospects I want to engage from multiple channels all in one place. It saves me so much time and energy as far as prospecting and organizing my day.”

—Gozie Nwachukwu, Head of Sales Development at Temporal

Product-led sales is now the standard for software companies. Subpar strategy shouldn’t be.

Uplevel your product-led sales strategy with Common Room

Ready to see how Common Room helps you turn product interest into product purchase?